This post was last updated on January 31st, 2022.

This post will show you how I got a quick instant loan without collateral and how you can take advantage of this platform, especially when you are stranded and need a quick loan to take care of urgent needs.

There are so many platforms or organizations out there that promise instant loans, but the requirements and guarantors are sometimes so high that it discourages many loan seekers.

I haven’t taken a loan before from a bank or any financial institution, but I have stood as a guarantor for many close people, including family and friends, and I know how difficult it is to get a loan. In addition, I have been doing research for loan opportunities to share with my subscribers.

The platforms where you can get instant loans focus on small loans for both personal and business needs. The more you are able to pay back without default, the greater the amount you can borrow subsequently.

The platform where I got a quick loan is Carbon. Carbon (formerly PayLater) is a simple, mobile online lending platform that provides short-term loans to help cover unexpected expenses or urgent cash needs. The platform is available on the Google Playstore. The website is www.getcarbon.co and if you are browsing from your mobile Android phone, click here to download Carbon from the Google Playstore.

I got to know about Carbon (formerly Paylater) last year when I saw their advert and also saw people sharing the platform via Whatsapp and Facebook, so I decided to check it out and installed the app and applied, but it wasn’t successful. Immediately, I deleted the app from my phone.

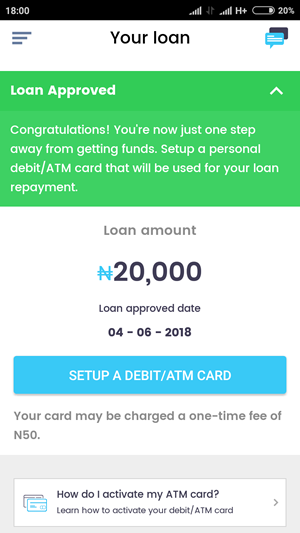

On the 4th of June, a colleague of mine in the office talked about it and shared his referral link with me for me to try them. I told him I didn’t need it and I had tried it before. He said I should try again and I should share it on my website since my website is all about funding and loan opportunities so that others will know. So I decided to try again, and within 5 minutes, I got approved for N20,000 instead of the N50,000 I requested.

The screenshots below show the alert. I was given 2 repayment dates, but I chose 15 days instead of 30 days. What surprises me is that for 15 days the interest is N3,00 while for 30 days it is N2,500.

For you to get approved, you must have a BVN number and also link your bank account for payment. You will also need to link your card too. N50 will be deducted to validate your account for the disbursement. The N50 will only be deducted once your loan is approved and is a one-time deduction.

Tips That Will Help You Get Approved

- Ensure that your BVN, bank account, and ATM card are readily available.

- Ensure the information you fill in the app corresponds with the details you submitted for your BVN registration. The reason why my first application was rejected was that the date of birth I provided was different from the one on my BVN. Your address on your BVN and the app should reflect on the ID card.

- Have a valid, government-issued means of identification.

- The location you are submitting your application from should be the same or nearby because the app will detect your location. If you are in Ogun State applying and you fill in an address in Lagos, that might affect your chance.

Pros

- Instant loan and a loan decision in minutes.

- No collateral needed.

- Simple application process

- No guarantor is needed unless you are applying for up to N1,000,000.

- Flexible loan repayment process (you can split repayment as many times as you want before the due date)

- Making on-time repayments can grant you access to higher credit limits for your next loan.

- Carbon is currently available throughout Nigeria.

- It is intended to meet urgent, short-term cash needs.

- You can re-apply for another loan immediately after your loan amount is fully paid off and may qualify for higher credit at a lower rate.

Cons

- You can only apply from your mobile device, and Carbon is currently only available on Android devices.

- You need a working internet connection to apply.

- Late payments can also affect your ability to borrow in the future, so please ensure timely repayment of your obligations.

- Failure to pay off any loans taken triggers a notice to the consumer credit reporting agency, which would negatively impact an individual’s credit score.

- It is not ideal for those who intend to service long-term debts.

Want to apply for an urgent and instant loan from Carbon?

Click here to download the app from playstore or visit www.getcarbon.co to check out their website.

Is There a Similar Platform Like Carbon?

Yes, there are many other platforms like Carbon. Another platform that I have tried and got approved for N7,500 loan is Aella Credit. Unfortunately, I didn’t accept because I wasn’t really interested and was just testing them out for the purpose of writing this post. Their website is www.aellacredit.com.

Do you know any other instant loan platform that is working, kindly use the comment box below to share with us.

Thank you for reading this post, don't forget to subscribe!

Are you interested in receiving the latest grant, funding, and business opportunities?

Join our newsletter for free and stay updated!

Click here to join our newsletter

Join our community:

Join our WhatsApp group

Join our Telegram group

Join our Facebook group